The Life Sciences BPO Market is estimated to be valued at US$ 385.8 Bn or Mn in 2023 and is expected to exhibit a CAGR of 14.% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

The Life Sciences BPO industry includes contract research organizations (CRO), contract manufacturing organizations (CMO), and contract sales and marketing organizations (CSMO) that provide outsourced services for pharmaceutical, biotechnology and medical device companies. Services provided include clinical trial management, data management, regulatory affair services, market research, quality control/quality assurance services, sales and marketing services. This industry helps the life sciences companies to focus on core competencies by outsourcing non-core functions to specialized service providers.

Market Dynamics:

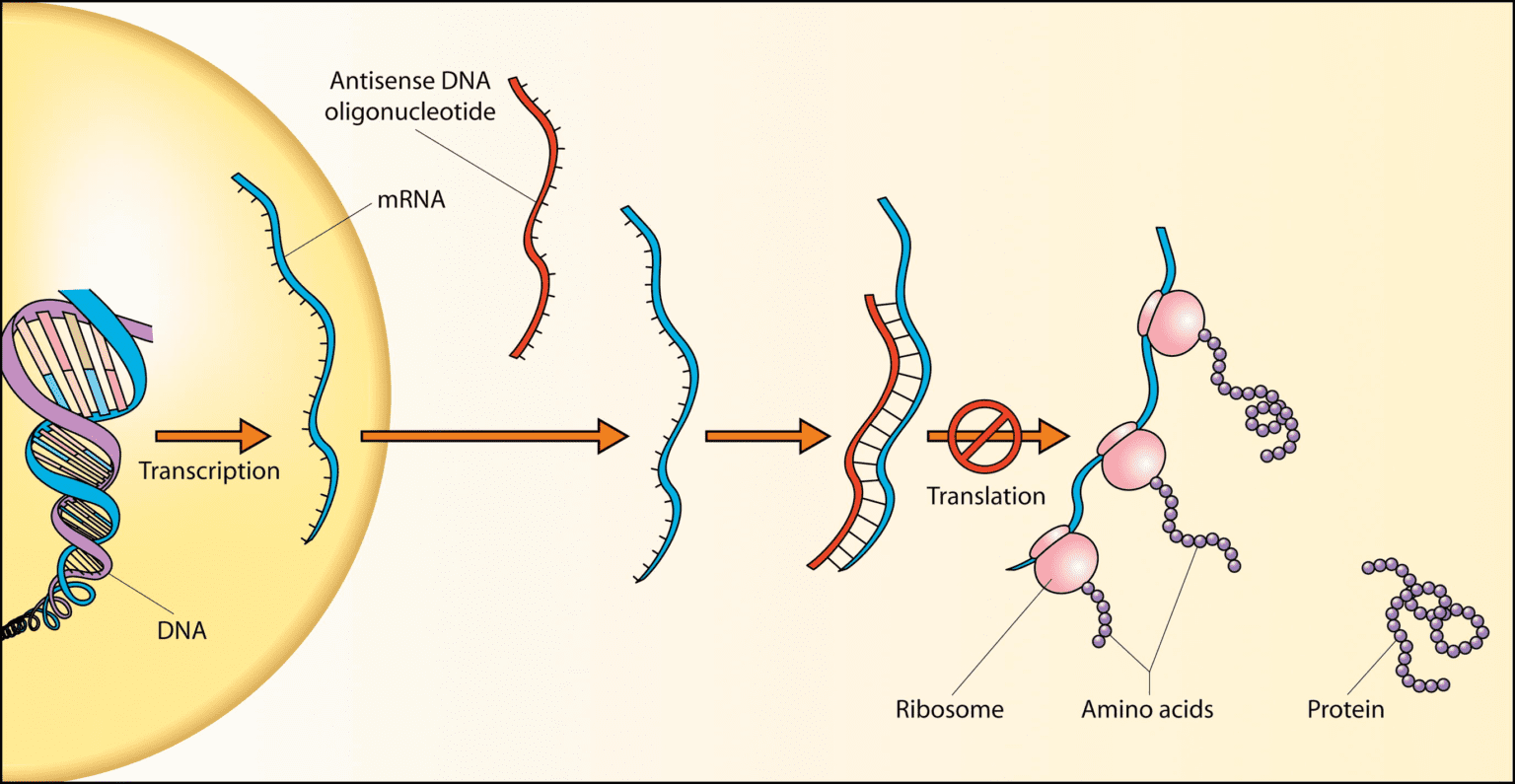

Increasing R&D expenditure in pharmaceutical and biotechnology industry is a key driver of this market. Pharmaceutical companies are increasingly outsourcing their R&D functions to CROs to reduce costs and improve efficiency. According to a report by IQVIA, global R&D spending in pharmaceutical and biotechnology industry increased from US$ 159 billion in 2012 to US$ 197 billion in 2018. Moreover, patent cliff of blockbuster drugs, rising demand for generics and biosimilars is necessitating high investment in developing novel drug pipelines. This is expected to increase dependence on CROs for drug development. Additionally, demand for contract manufacturing is growing due to increasing production of biologics. However, compliance issues regarding handling of sensitive patient data and concerns over loss of intellectual property are some factors that may hinder the market growth.

Segment Analysis

The life sciences BPO market is dominated by the contract research organizations or CROs segment. CROs help life sciences companies in various drug development processes like clinical trials, regulatory filings, preclinical and discovery studies. CROs sub-segment held over 55% share in 2022 due to their wide range of services from drug discovery to post marketing studies. They conduct research across all phases of clinical trials for biopharmaceutical and medical device companies on an outsourced basis thus benefiting pharmaceutical companies with reduced costs and greater focus on core competencies.

PEST Analysis

Political: Regulatory requirements for drug development and approvals are getting stringent. Political stability and government support for life sciences sector is an important driver.

Economic: Growing healthcare expenditure worldwide along with patent cliffs and cost pressures on pharmaceutical companies is boosting outsourcing of R&D and non-corefunctions.

Social: Aging population and growing lifestyle diseases are increasing demand for new medicines thus importance of drug innovation.

Technological: Adoption of AI, machine learning and advanced analytics is helping enhance efficiency of clinical trials and reduce costs for life sciences companies.

Key Takeaways

The global Life Sciences BPO Market Share is expected to witness high growth, exhibiting CAGR of 14.% over the forecast period, due to increasing cost pressures on pharma companies and fast track drug approval pathways.

The North American region dominates the market and is expected to continue its dominance over the forecast period. This is attributed to presence of majority of life sciences companies and CROs along with growing biosimilars market in the region.

Key players operating in the life sciences BPO market are Accenture, Plc., Boehringer Ingelheim GmbH, Charles River Laboratories International, Inc., Cognizant Technology Solutions, Covance, Inc., DSM, Fareva, ICON, Plc, Infosys, Catalent, Inc., Genpact Limited, Health Decisions, Inc., and ProMab Biotechnologies, Inc. Pharmaceutical outsourcing to such big players is helping smaller pharma companies to focus on core competencies.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it