The India And Oman Pharmaceutical Industry Market is estimated to be valued at US$ 59924.05 Mn in 2023 and is expected to exhibit a CAGR of 12.% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

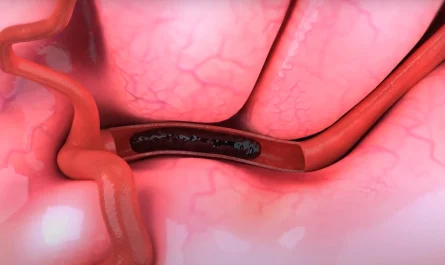

The India And Oman pharmaceutical industry produces a range of generic, branded generic, patented and biologics medicines across various therapeutic categories including diabetes, cardiovascular, oncology, pain management and dermatology. The pharmaceutical industry in India is majorly driven by exports and supplies affordable, high-quality generic medicines globally.

Market key trends:

One of the major trends driving growth of the India and Oman pharmaceutical industry market is increasing healthcare spending across both countries. According to data, healthcare spending in India is expected to increase at a CAGR of 22% over 2022–2027 to reach US$ 372 billion in 2027 from US$ 220 billion in 2022. Similarly, healthcare spending in Oman has been increasing at a rate of around 5-6% annually over the past few years and reached around US$ 2.3 billion in 2020. Rising income levels and growing health awareness are prompting people to spend more on healthcare. This rising healthcare expenditure is boosting demand for pharmaceutical products across therapies which is fueling market growth.

Porter’s Analysis

Threat of new entrants: The threat of new entrants in the India And Oman Pharmaceutical Industry is medium as the capital requirement and stringent regulations act as a deterrent for new players . However, generic drug manufacturing has lower entry barriers.

Bargaining power of buyers: The bargaining power of buyers is high as medicines are necessities and many generic alternatives are available. Buyers can negotiate on prices and switch to cheaper substitutes.

Bargaining power of suppliers: Pharmaceutical companies often rely on a limited number of suppliers for active pharmaceutical ingredients. This gives suppliers a certain bargaining power over companies.

Threat of new substitutes: The threat of new substitutes is medium to high due to continuous innovation and availability of generic drugs. Biosimilars also pose a threat to blockbuster drugs.

Competitive rivalry: The competition in the industry is high due to presence of local and multinational companies.

SWOT Analysis

Strengths: Established distribution networks, strong brand recognition, skilled workforce and R&D capabilities provide an advantage to leading players.

Weaknesses: High dependency on few blockbuster drugs, patent cliff of many drugs, stringent regulations and time consuming approval process.

Opportunities: Rapid growth in generics market, rising healthcare expenditure, focus on specialty drugs, medical tourism are key growth drivers.

Threats: Price controls and drug price regulation, intensifying competition, high manufacturing costs affect profits.

Key Takeaways

India And Oman Pharmaceutical Industry Market Size is expected to witness high growth, exhibiting CAGR of 12% over the forecast period, due to increasing prevalence of chronic diseases and rising healthcare expenditure.

Regional analysis: India dominates the market owing to the large production capacity of generics. India accounts for 20% of global exports of generic medicines by volume. The Oman market is growing at a fast pace bolstered by initiatives to develop local manufacturing and large infrastructure projects.

Key players operating in the India And Oman Pharmaceutical Industry include Pfizer, Inc., Bristol Myers Squibb, Sanofi S.A., F. Hoffmann-La Roche AG, Bayer AG, Novartis International AG, Merck & Co., Inc., AbbVie, GlaxoSmithKline plc, Eli Lilly and Company, Zydus Cadila, Aurobindo Pharma Ltd., Cipla Ltd., Dr. Reddy’s Laboratories Ltd., Lupin Ltd., Sun Pharmaceutical Industries Limited, Serum Institute of India Pvt. Ltd., Biocon Limited, Strides Pharma Science Limited, and Unichem Laboratories.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it