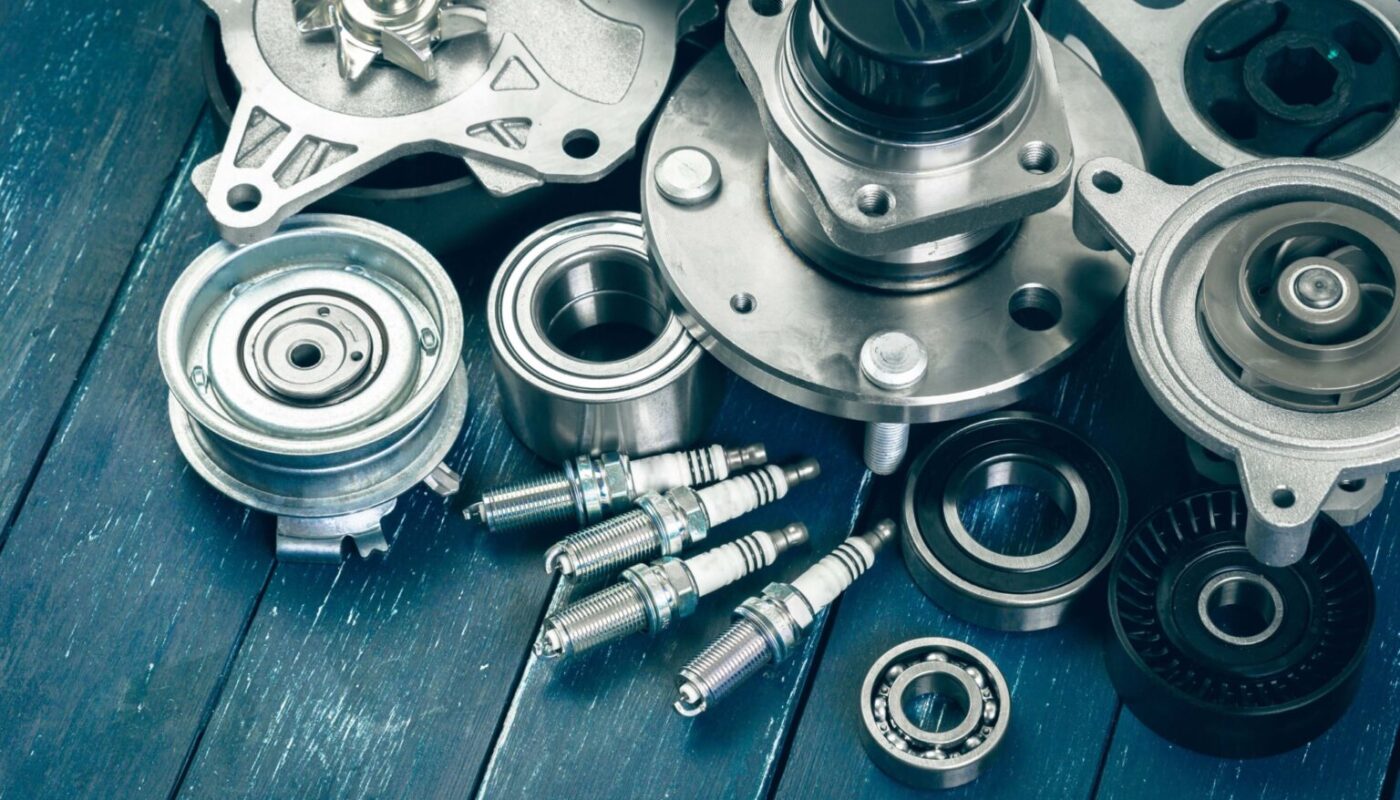

The automotive parts remanufacturing process involves disassembling used automotive components and parts, inspecting and testing their condition, replacing worn or damaged components, and reassembling the components to “like-new” condition. Remanufactured automotive components like engines, transmissions, turbochargers and others offer a cost-effective alternative to new components for vehicle owners as well as automotive repair shops. Remanufacturing extends the useful life of core components by bringing them back to original quality specifications. The advantages of using remanufactured automotive parts over new ones include cheaper pricing without compromising on performance and quality. With rising vehicular pollution levels across major cities in Europe, stringent emission norms have been implemented to curb air pollution and reduce the carbon footprint of the transportation industry. This is driving more consumers to consider replacing old vehicle parts with remanufactured versions as a viable and affordable way to keep their vehicles running efficiently in compliance with emission standards.

The Europe Automotive Parts Remanufacturing Market is estimated to be valued at US$ 15.34 Mn in 2023 and is expected to exhibit a CAGR of 38% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market key trends:

Demand for remanufactured components from commercial fleets is gaining traction as fleet owners look to replace parts economically while meeting regulatory and sustainability targets. Commercial vehicle fleets in Europe undergo regular maintenance and repairs involving part replacements. Remanufactured components are an attractive choice for fleet owners looking to reduce operating costs without compromising on quality or reliability. The market is witnessing rising acceptance of remanufactured parts for applications across engine, transmission, turbochargers and other core components. This is being driven by their value proposition of providing a sustainable, affordable alternative to procuring new parts.

Porter’s Analysis

Threat of new entrants: Low. The automotive parts remanufacturing industry in Europe requires large investments and has well-established players, posing significant barriers to entry.

Bargaining power of buyers: Moderate. The buyers include automotive OEMs and independent car mechanics. Their bargaining power is moderate due to the availability of remanufactured as well as new parts.

Bargaining power of suppliers: Low. The suppliers include core collection and remanufacturing companies. Their dependence on remanufacturers for parts sales results in low bargaining power.

Threat of new substitutes: Low. There are currently no close substitutes for remanufactured automotive parts that offer the perfect balance of quality and cost.

Competitive rivalry: High. The market is dominated by a few global players intensely competing on quality, technology, price and service.

Key Takeaways

The Europe automotive parts remanufacturing market size is expected to witness high growth driven by strict emission regulations, rising vehicle recalls, and growing demand for cost-effective replacements. The Europe Automotive Parts Remanufacturing Market is estimated to be valued at US$ 15.34 Mn in 2023 and is expected to exhibit a CAGR of 38% over the forecast period 2023 to 2030.

Regional analysis:

Germany dominates the Europe market accounting for over 30% share owing to stringent emission norms and presence of major automakers. The UK and France are other major markets in the region.

Key players: Key players operating in the Europe automotive parts remanufacturing market are AnaSpec, BioneXt, AMC, and Wesco Aircraft Holdings. They offer a wide range of remanufactured parts for engines, transmission, fuel systems, and others supported by advanced diagnostics and reverse engineering capabilities.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it