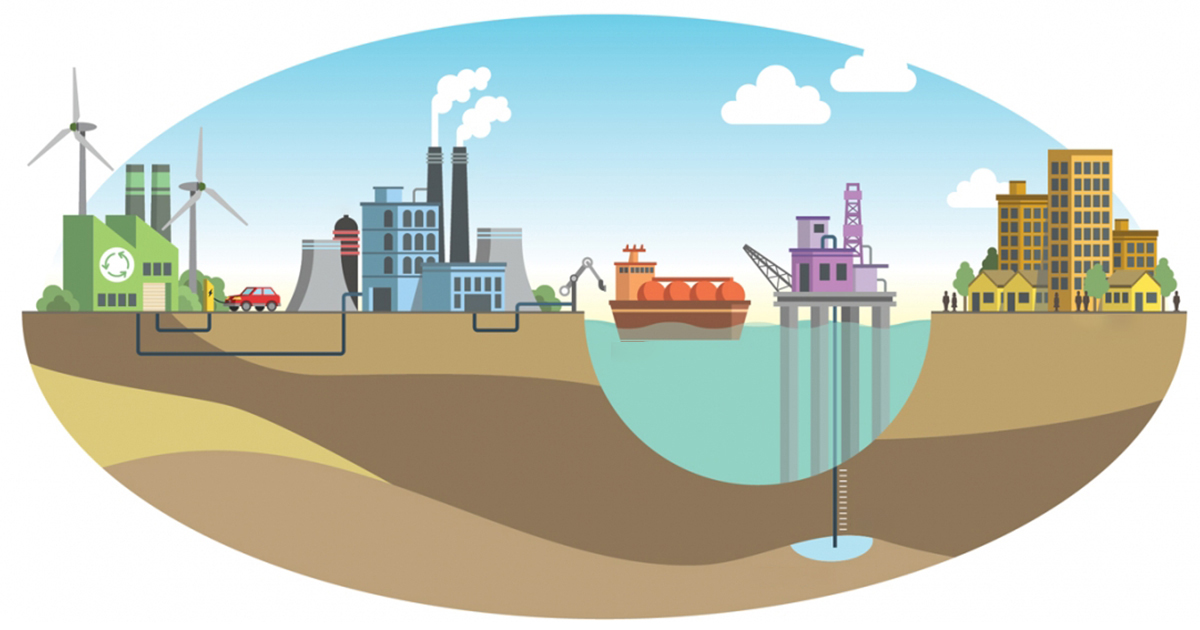

The Climate and Carbon Finance Market is driven by growing concerns around global warming and climate change. Climate finance includes financial flows that help countries transition to cleaner energy and adapt to a changing climate. Carbon finance encompasses trading schemes and markets that put a price on emissions in order to mitigate climate change. Carbon credits are traded when a project helps reduce greenhouse gas emissions that can then be sold to companies and governments looking to lower their carbon footprint.

Climate change poses both risks and opportunities to businesses across all sectors. Many companies are investing in carbon offsetting projects and renewable energy to lower operating costs over the long run while demonstrating sustainability leadership. Carbon credits have become a mainstream tool for corporates to balance carbon footprints while supporting initiatives like reforestation, renewable power generation, and clean cooking solutions in developing nations. The global Climate and Carbon Finance Market is estimated to be valued at US$ 459.58 Mn in 2023 and is expected to exhibit a CAGR of 3.6% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

Market key trends:

The carbon finance market is focused on transitioning to a lower-carbon economy through regulatory instruments. The implementation of carbon pricing policies like carbon taxes and emissions trading schemes across many nations is a major trend. As of 2021, 64 national and sub-national jurisdictions have implemented or are scheduled to implement carbon pricing, covering 22% of global emissions. This wide-scale adoption will further increase demand for carbon credits for offsetting purposes. Another key trend is businesses pledging net-zero emissions targets by 2050 which is spurring investments in decarbonization efforts and technologies across industries. Voluntary carbon credit markets are also expanding as a way for companies and individuals to neutralize emissions beyond compliance obligations. Greater participation from private sector finance will be critical for scaling up climate solutions globally.

Porter’s Analysis

Threat of new entrants: The threat of new entrants is moderate due to the large capital requirements and expertise needed to compete in climate finance. Bargaining power of buyers: The bargaining power of buyers is high since there are many alternatives available in the market. Bargaining power of suppliers: Suppliers have low bargaining power as there are many suppliers in the market. Threat of new substitutes: The threat of new substitutes is high as various fintech companies are providing innovative solutions. Competitive rivalry: The competition in the market is high due to the presence of many regional and international players.

Key Takeaways

The global Climate And Carbon Finance Market size is expected to witness high growth.

Regional analysis: The Asia Pacific region is projected to grow at the highest CAGR during the forecast period. Countries like China and India are focusing on renewable energy sources and offering tax benefits which is supporting the market growth.

Key players related content comprises Key players operating in the Climate And Carbon Finance market are International Paper C, Kinross Gold Corporation, Barrick Gold Corporation, Newmont Mining Corporation. International Paper is one of the leading players and offers wide range of carbon offset and renewable energy credits.

*Note:

- Source: Coherent Market Insights, Public sources, Desk research

- We have leveraged AI tools to mine information and compile it