The chlor-alkali market has the global production processes as well as applications in various end-use industries such as chemical processing, water treatment, pulp & paper production among others. Chlor-alkali is primarily used in the production of caustic soda, chlorine, and hydrogen. The applications of caustic soda range from alumina and pulp & paper production, soap & detergent, textile processing, petroleum refining, and others. Chlorine has widespread applications in producing polyvinyl chloride (PVC), ethylene dichloride (EDC), isopropyl alcohol among others. Hydrogen finds uses in processing edible fats and oils, refining petroleum products and manufacturing ammonia. With growing demand for chemicals, polymers, and other end products, the demand for chlor-alkali is expected to surge over the forecast period.

The global Chlor-Alkali Market is estimated to be valued at US$ 263531.83 Mn in 2023 and is expected to exhibit a CAGR of 6.9% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market key trends:

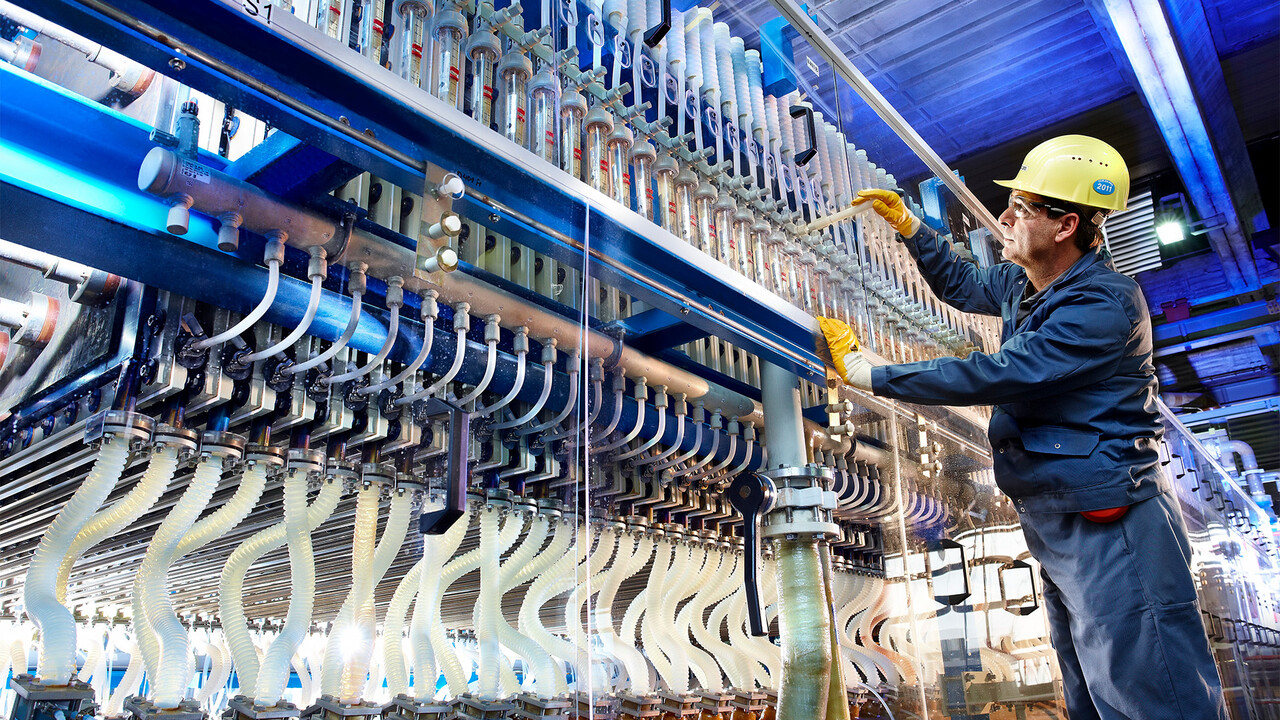

One of the major trends observed in the Global Chlor-Alkali Market Size is growing preference for mercury-cell technology over membrane cell technology. Mercury cell technology has been the preferred method for chlor-alkali production owing to its high yield and energy efficiency. However, concerns regarding mercury emissions have led to increased adoption of environment-friendly membrane cell technology. The membrane cell technology does not use mercury during production and offers closed system with negligible emissions. Additionally, stringent regulatory norms in Western countries regarding mercury emissions are further propelling the demand for membrane cell technology. Despite higher costs, many chlor-alkali producers are investing in transitioning to advanced membrane cell technology to comply with sustainability goals and regulations. This shift towards greener production technologies is expected to remain a key trend in the global chlor-alkali market over the forecast period.

Porter’s Analysis

Threat of new entrants: The threat of new entrants is moderate as setting up a chlor-alkali plant requires high capital investments. However, expansion of existing players poses moderate threat.

Bargaining power of buyers: The bargaining power of buyers is moderate to high as the buyers can switch between suppliers based on price and performance.

Bargaining power of suppliers: The bargaining power of suppliers is low to moderate as the key raw materials for chlor-alkali production such as salt, power and transportation are available at low costs from different suppliers.

Threat of new substitutes: The threat from new substitutes is low as there are limited alternatives available for chlorine and caustic soda.

Competitive rivalry: The competitive rivalry is high among the key global players operating in the chlor-alkali market.

Key Takeaways

The global chlor-alkali market is expected to witness high growth over the forecast period of 2023 to 2030.

Regional analysis shows that Asia Pacific holds the largest market share currently owing to presence of key players and high demand from end-use industries in the region. Countries like China, India are dominating the Asia Pacific chlor-alkali market.

Key players operating in the chlor-alkali market are 3D Systems Corporation, 3M Company, 3Shape A/S, Align Technology, Inc., Bernhard Förster GmbH, Carestream Dental, LLC, and American Orthodontics Corporation, among others. Increased adoption in applications such as production of pulp & paper, alumina, organic chemicals and water treatment is driving the growth of these players.

The chlor-alkali market is dominated by large global players. Strategic partnerships and capacity expansion through mergers & acquisitions are the key strategies adopted by major players to gain competitive advantage. For instance, in 2022, US based conglomerate giant Olin Corporation acquired chlor alkali business of K.A. Steel Chemicals for $1 billion to expand its footprint.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it