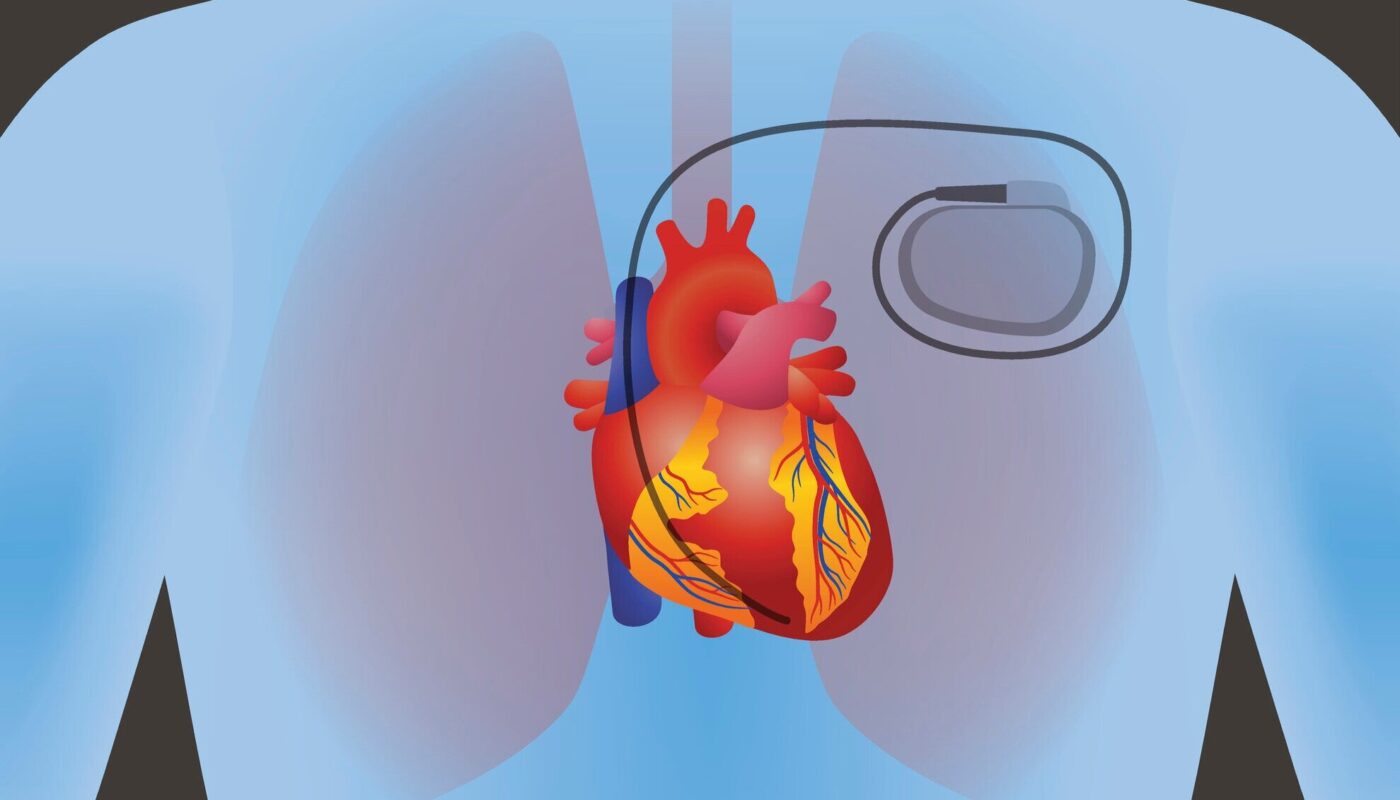

Cardiac Implantable Electronic Devices (CIEDs) including implantable pacemakers and implantable cardioverter defibrillators (ICDs) are medical devices used for monitoring and regulating heartbeat. They are small battery-powered devices implanted in the chest to treat arrhythmias or cardiac rhythm irregularities caused by conditions like heart block or heart failure. CIEDs help improve the quality of life for patients suffering from arrhythmias by continuously monitoring the heart for irregular heart rhythms and delivering electrical therapy either by pacing the heart or providing defibrillation shocks.

The global Cardiac Implantable Electronic Device Market is estimated to be valued at US$ 28.1 Bn in 2023 and is expected to exhibit a CAGR of 7.8% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market key trends:

One of the key trends in the cardiac implantable electronic device market size is the growing adoption of MRI-conditional devices. Conventional pacemakers and ICDs pose risks during magnetic resonance imaging (MRI) scans due to potential interactions between the strong magnetic fields and the implanted electronic devices. However, MRI-conditional CIEDs are specifically designed and tested to be safe for MRI scans under certain conditions. The availability of such devices allows patients with implanted CIEDs to safely undergo MRI procedures for diagnostic purposes without having to remove or replace the device. This provides considerable benefits and flexibility to physicians and patients. Growing acceptance of MRI-conditional devices is expected to significantly contribute to the market growth over the forecast period.

Porter’s Analysis

Threat of new entrants: The threat of new entrants is moderate in the cardiac implantable electronic device market as it requires huge capital investments and compliance with stringent regulations. However, major players are focusing on new product developments which can increase competition.

Bargaining power of buyers: The bargaining power of buyers is moderate due to the presence of large number of players offering similar products. Buyers can easily switch between brands based on product quality and pricing.

Bargaining power of suppliers: The bargaining power of suppliers is low since raw materials required are commodity chemicals and device parts which are abundantly available.

Threat of new substitutes: The threat of new substitutes is low in the cardiac implantable electronic device market since there are limited treatment options for cardiac disorders currently.

Competitive rivalry: The competitive rivalry is high among existing players due to the presence of large number of global and regional players offering comparable products. Players often engage in new product launches and strategic collaborations to strengthen their market position.

Key Takeaways

The global Cardiac Implantable Electronic Device Market is expected to witness high growth. The market is projected to reach a value of US$ 47.1 Bn by 2030 from US$ 28.1 Bn in 2023, expanding at a CAGR of 7.8% during the forecast period.

Regional analysis: North America dominated the global market in 2021 and is expected to maintain its dominance during the forecast period owing to advanced healthcare infrastructure and growing prevalence of cardiovascular diseases in the region. Asia Pacific is expected to witness fastest growth attributed to rising healthcare expenditure, presence of large patient pool and growing medical tourism in the region.

Key players: Key players operating in the Cardiac Implantable Electronic Device Market are Medtronic, Biotronik, Boston Scientific Corporation, Pacetronix.com, Integer Holdings Corporation, Cook Group, Braile Biomédica, Abbott, LivaNova PLC, OSYPKA Medical, Galix Biomedical Instrumentation Inc., OSCOR Inc., LifeTech Scientific Corporation, MicroPort Scientific Corporation, and Ceryx Medical. Abbott accounted for the largest share in 2021 and companies are largely engaged in new product launches and strategic collaborations to strengthen their market position.