With greenhouse gas emissions being one of the major contributors to climate change, carbon verification is gaining prominence as a service to validate the reported emissions from organizations to fulfill regulatory obligations and voluntary commitments. Carbon verification aids in ensuring compliance with applicable climate regulations and improving environmental credibility of businesses by verifying the quantity and quality of carbon credits and offsets generated. The growing shift towards a low-carbon economy along with stringent regulations around emissions monitoring and reporting have propelled the demand for third-party verification of carbon footprints.

The global Carbon Verification Market is estimated to be valued at US$ 12.73 billion in 2023 and is expected to exhibit a CAGR of 26% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market key trends:

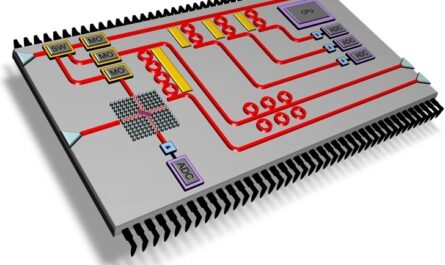

Blockchain technology is emerging as an innovative solution that can enhance the transparency, accuracy, and security of carbon credit issuance and trading. It facilitates immutable recording of carbon offset projects and transactions on distributed digital ledgers. This prevents double counting of credits and provides undisputable proof of ownership. Several carbon markets are exploring the potential of blockchain to digitize carbon assets and streamline the verification process. For instance, an Indonesia-focused carbon trading platform called Carbon Click leverages blockchain to trace carbon credits from verification to retirement. The uptake of blockchain is expected to accelerate over the coming years to bring more efficiency in carbon accounting and build trust in carbon markets.

Porter’s Analysis

Threat of new entrants: The Global Carbon Verification Market Size requires huge capital investments as well as resources and expertise for verifying emissions reductions, making it difficult for new players to enter.

Bargaining power of buyers: Large companies dealing with carbon credits have significant bargaining power over verification agencies to negotiate pricing and demand high quality verifications.

Bargaining power of suppliers: Verification agencies have strong bargaining power over certification bodies and standards providers as they can switch between different standards based on costs and ease of operations.

Threat of new substitutes: There are limited product substitutes for carbon verification due to stringent regulatory norms requiring independent third party verification for carbon credits.

Competitive rivalry: The carbon verification market is an oligopoly with a few large global players dominating the market. However, competition remains high based on pricing, domain expertise, and quality of verification processes.

Key Takeaways

The global carbon verification market is expected to witness high growth over the forecast period supported by stringent emission regulation worldwide and growing carbon credit trading. The global Carbon Verification Market is estimated to be valued at US$ 12.73 billion in 2023 and is expected to exhibit a CAGR of 26% over the forecast period 2023 to 2030.

Regional analysis: Europe accounts for over 30% of the global carbon verification market share led by countries such as the UK, Germany, and France. Stringent emission norms under the EU ETS and presence of leading verification agencies have boosted adoption. The Asia Pacific region is projected to witness the fastest growth during the forecast period led by China, Japan, and India as emission targets become more ambitious.

Key players: Key players operating in the carbon verification market are DNV GL, SGS SA, Bureau Veritas, Intertek Group plc, Carbon Trust, First Environment, Inc., ERM Certification and Verification Services, NSF International, UL LLC, Cotecna, SCS Global Services, KPMG International Cooperative, Deloitte Touche Tohmatsu Limited, and PwC. Major players are focusing on geographical expansion and investing in new technologies to automate verification processes and reduce costs.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it